SEO Keywords Targeted

Smart Dispute & Payment Matching Tool

In last mile logistics, getting paid accurately and on time is just as important as delivering the order. However, invoice mismatches, short payments, and disputes are all too common—especially when managing large volumes of transactions across retailers and TMS platforms.

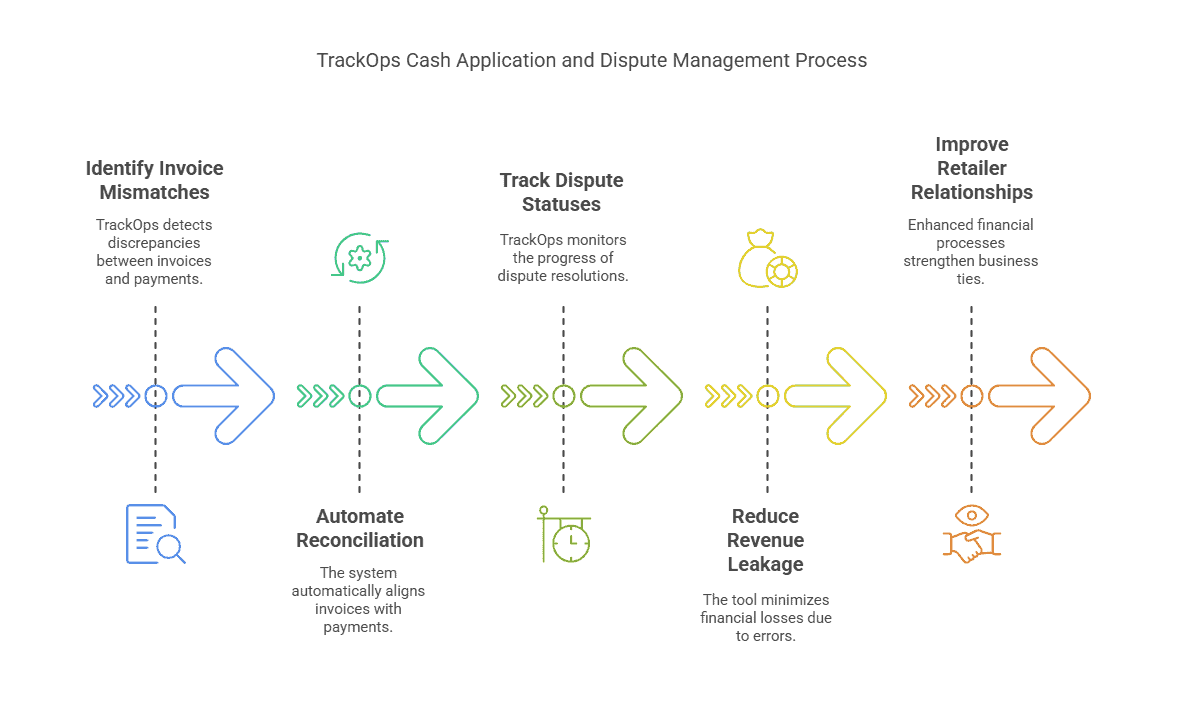

That’s why TrackOps, developed by Mondo Cloud Solutions in London, Ontario, features a powerful Cash Application and Dispute Management module. This tool automates the reconciliation between invoices and payments, identifies mismatches, and tracks dispute statuses—all in real-time.

Whether you’re operating in Canada or the U.S., TrackOps helps you stay on top of your receivables, reduce revenue leakage, and improve retailer relationships.

What Is Cash App & Dispute Management?

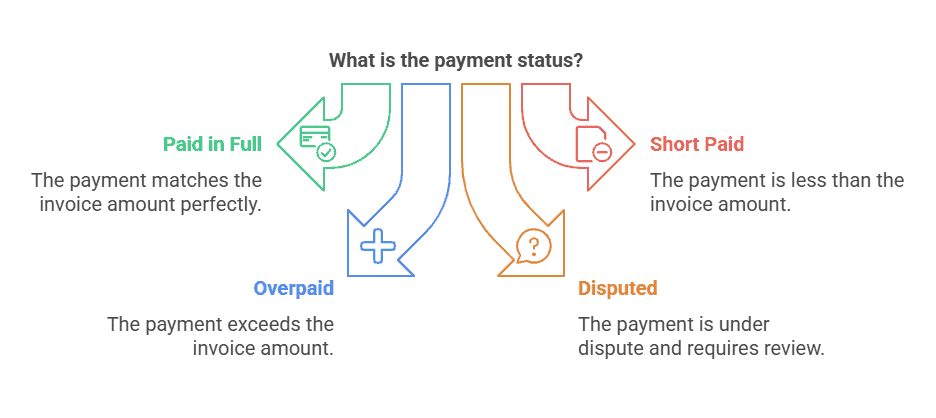

This module is designed to match payments with their corresponding invoices using rules-based logic and integrated status updates. When payments are received via PDF, API, XML, CSV, or EDI 820, TrackOps automatically links them to the correct invoice and identifies whether the amount is:

✅ Paid in full

❌ Short paid

🔁 Overpaid

📌 Disputed

It also tracks the reason codes and documentation (such as POD images or delivery exceptions), allowing your team to respond proactively.

Supported Formats:

TrackOps supports payment and dispute data in:

EDI 820 (Payment Order/Remittance Advice)

CSV/Excel Uploads

PDF-based remittances (with OCR integration)

JSON/XML API inputs

How It Works – Step by Step

1. Payment Receipt

Retailers submit payment data through your preferred format. TrackOps ingests the file or API and begins matching.

2. Invoice Matching

Using delivery reference, date, amount, or PO numbers, the system matches the payment to the invoice generated through the Billing Automation module.

3. Status Assignment

Invoices are marked as:

– Paid

– Short Paid

– Overpaid

– Disputed TrackOps records each transaction and any attached notes or codes from the retailer.

4. Dispute Logging

If a dispute is detected (e.g., delivery marked incomplete), the system logs the case, links it to the delivery and POD data, and flags it for resolution.

5. Aging Report Generation

TrackOps builds a real-time aging report at the delivery level, allowing your finance and operations teams to act fast.

Connected TrackOps Modules

This module is closely tied to several other services:

Billing Automation: Invoices come directly from status-triggered billing

Status Updates: Confirms delivery status tied to billing and payment validation

Inventory Scanning: Verifies SKU-level accuracy for disputed deliveries

Business Analytics: Tracks dispute trends, cash flow, and DSO (Days Sales Outstanding)

Complementary Mondo Services That Add Value

You can further enhance your cash management process using:

Office 365 Integration

Automate aging reports, dispute alerts, and payment summaries via email to accounting teams or retailer finance contacts.

VoIP Integration

Allow accounting teams to follow up disputes or payment issues via Cloudli VoIP with click-to-call functionality tied to invoice records.

Secure Finance Portal

Give internal teams or partners real-time access to payment status and open disputes through a secure web interface.

Network Infrastructure

Ensure sensitive payment data is transmitted securely and reliably across all systems.

Real-Life Scenario:

A carrier in Ontario was losing over $10,000/month due to untracked short payments. After implementing TrackOps’ Cash App module:

95% of payments matched automatically

Dispute resolution time dropped by 60%

Weekly aging reports became fully automated

Collections became proactive instead of reactive

Key Benefits:

✔ Accurate invoice-to-payment matching

✔ Fast resolution of short/overpaid invoices

✔ Centralized dispute tracking

✔ Real-time aging visibility

✔ Reduced revenue leakage

✔ Integrated with billing and delivery data

Conclusion:

For last mile carriers and logistics providers, managing cash flow doesn’t have to be a struggle. With TrackOps Cash App & Dispute Management, you gain full visibility into your receivables, automate tedious reconciliation tasks, and resolve disputes faster than ever.

In a competitive logistics environment—especially across Canada and the U.S., and for operations in London, Ontario—this module ensures that your delivery performance translates into cash in the bank.

Over 1.3M orders & invoices processed

trusted by 50+ global partners for 12+ years.